NEWS & EVENTS

23 March 2024

23 March 2024

The Canada Revenue Agency (CRA) is dedicated to providing you with the highest quality service in the most efficient way possible. Here you will find questions and answers about the new trust reporting rules.

22 March 2024

22 March 2024

The Underused Housing Tax is an annual 1% tax on the ownership of vacant or underused housing in Canada that took effect on January 1, 2022. The tax usually applies to non-resident, non-Canadian owners. In some situations, however, it also applies to Canadian owners.

This is a summary of some of the most important information about the Underused Housing Tax. More information and details about the tax will be available over the coming weeks.

This is a summary of some of the most important information about the Underused Housing Tax. More information and details about the tax will be available over the coming weeks.

22 July 2020

22 July 2020

The Government of Canada, through Western Economic Diversification Canada, is providing loans of up to $40,000 for eligible women-run businesses to help businesses cope with financial hardship and recovery from economic disruption resulting from COVID-19.

17 July 2020

17 July 2020

The Government of Canada is taking immediate, significant and decisive action through Canada’s COVID-19 Economic Response Plan to support Canadians and protect jobs during the global COVID-19 pandemic, and to better position them for a strong recovery.

23 April 2020

23 April 2020

The B.C. Emergency Benefit for Workers will provide a tax-free, one time $1,000 payment for B.C. residents whose ability to work has been affected due to COVID-19.

22 April 2020

22 April 2020

As a Canadian employer whose business has been affected by COVID-19, you may be eligible for a subsidy of 75% of employee wages for up to 12 weeks, retroactive from March 15, 2020, to June 6, 2020.

15 April 2020

15 April 2020

To help employers keep and return workers to their payroll through the challenges posed by the COVID-19 pandemic, the Prime Minister, Justin Trudeau, announced the new Canada Emergency Wage Subsidy

15 April 2020

15 April 2020

Emergency benefits to be made available in April for those who don't qualify for EI. Prime Minister Justin Trudeau announces the government's $82 billion emergency response package at a news conference outside Rideau Cottage in Ottawa on Wednesday.

29 March 2020

29 March 2020

Emergency benefits to be made available in April for those who don't qualify for EI. Prime Minister Justin Trudeau announces the government's $82 billion emergency response package at a news conference outside Rideau Cottage in Ottawa on Wednesday.

18 March 2020

18 March 2020

Emergency benefits to be made available in April for those who don't qualify for EI. Prime Minister Justin Trudeau announces the government's $82 billion emergency response package at a news conference outside Rideau Cottage in Ottawa on Wednesday.

22 November 2019

22 November 2019

Date:Nov 23, 2019 (Saturday) 10:00 PM - 12:00 PM

Location:RBC Marine Gateway Advisor Office 3 Floor, 456 SW Marine Dr. Vancouver

(Entrance located next to CINEPLEX )

Location:RBC Marine Gateway Advisor Office 3 Floor, 456 SW Marine Dr. Vancouver

(Entrance located next to CINEPLEX )

21 February 2019

21 February 2019

Date:Feb 23, 2019 (Wednesday) 3:00 PM - 5:00 PM

Location:South Surrey Recreation Centre - MP1

14601 20 Ave, Surrey BC

Location:South Surrey Recreation Centre - MP1

14601 20 Ave, Surrey BC

25 October 2018

25 October 2018

The speculation and vacancy tax is designed to prevent housing speculation and help turn vacant and underutilized properties into homes for people who live and work in B.C. The tax is a part of the B.C. government’s 30-Point Plan to address the housing crisis and help make life more affordable for people.

28 February 2018

28 February 2018

The Liberal government’s third full budget was expected to be a relatively lean one with any big moves saved until next year when a federal election is on the line. When it comes to measures that directly impact Canadian pocketbooks, it was a light budget indeed.

20 February 2018

20 February 2018

The B.C. government delivered on a wide variety of promises from its election platform and throne speech in its first budget, forecasting a $219 million surplus for the upcoming fiscal year on the strength of a strong economy.

2 January 2018

2 January 2018

Jan. 2, 2018, Sunny Sun was invited to Y2018 first TV live talk on Fairchild TV program to talk about "RRSP/TFSA Investment" and "2017-2018 Tax update". Host is Mr. Fred Liu & another guest speaker is Mr. Nick Lai.

1 January 2018

1 January 2018

Canadian small businesses will see a drop in their tax rate to 10 per cent from 10.5 per cent on Jan. 1. Other New Year`s changes include the return of the immigration sponsorship program and a big minimum-wage increase in Ontario.

27 December 2017

27 December 2017

Property taxes, grocery going up; but MSP, natural gas going down. British Columbians can expect to spend more on car insurance and groceries this year, but MSP is dropping.

12 September 2017

12 September 2017

B.C.'s new. government will spend $51.9 billion for this fiscal year to support the NDP'S stated goal of making the province more affordable for residents. It's a balanced budget but nearly $2 billion more than the B.C. Liberals planned to spend in their February budget.

27 March 2017

27 March 2017

Channel: FM 96.1 Radio "Tax Talk"

Schedule: March 28 and April 4. on Air ( 6-7 PM )

Channel: "City TV"

Schedule: 9:25-10:30 PM on March 28 (Tuesday)

Schedule: March 28 and April 4. on Air ( 6-7 PM )

Channel: "City TV"

Schedule: 9:25-10:30 PM on March 28 (Tuesday)

22 March 2017

22 March 2017

The Liberal government has delivered a budget designed to brace Canadians for a fast-changing global economy and empower women in the workforce, while taking a wait-and-see approach to sweeping changes south of the border.

14 March 2017

14 March 2017

Sunny Sun was invited by Ms.Carmen Shao of "City TV" to attend tax topic program to speak on hot tax topics , such as current CRA auditing on overseas tax evasion and house flipping, tax treaty and banking information exchange tax issues.

1 March 2017

1 March 2017

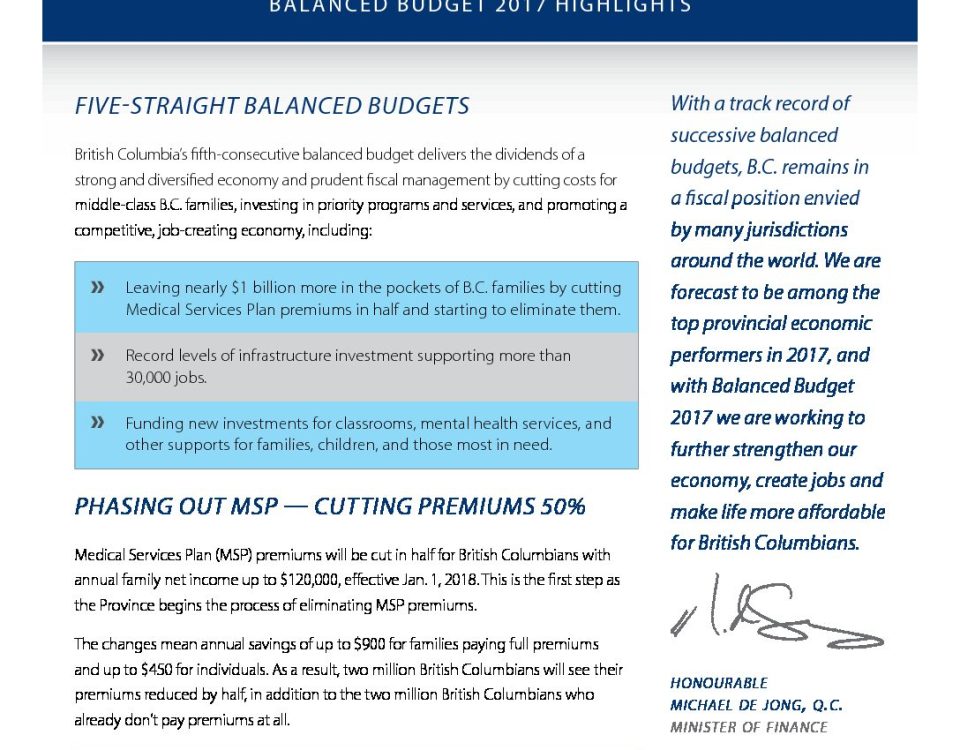

British Columbia’s fifth-consecutive balanced budget delivers the dividends of a strong and diversified economy and prudent fiscal management by cutting costs for middle-class B.C. families, investing in priority programs and services, and promoting a competitive, job-creating economy...

17 February 2017

17 February 2017

On April 15, 2016, the Department of Finance Canada announced legislative proposals for consultation to implement the Common Reporting Standard in Canada. The following questions and answers give more information and tax administration perspectives about the Common Reporting Standard.

13 February 2017

13 February 2017

Fewer people in their prime-aged working years contribute to registered retirement savings plans (RRSPs) now than they used to, according to new data analysis by Statistics Canada.

1 February 2017

1 February 2017

There is plenty of debate about whether RRSPs or TFSAs are the best place to park your savings, but financial advisers say if you understand the advantages and disadvantages of each, there is little reason not to use both.

23 December 2016

23 December 2016

Every British Columbian deserves a place to call home. That is why we are taking action by controlling the cost of housing, increasing access to affordable rental units, and partnering with families to help make their dream of home ownership come true.

24 October 2016

24 October 2016

Members of the Richmond Chamber and their guests are invited to attend a seminar and luncheon entitled "Business Alliance with Taiwan: Your Gateway to Asia". Tom Lee, Director-General of the Taipei Economic and Cultural Office in Vancouver (TECO) and Ruth Chang, Director of the Taiwan Trade Centre Vancouver will outline Taiwan's strategic opportunities for Canadian businesses at this excellent networking luncheon.

19 October 2016

19 October 2016

The Canada Revenue Agency’s crackdown on tax fraud in the overheated real estate markets of Ontario and British Columbia is bearing fruit, with auditors recovering $240-million in unpaid taxes and $12.5-million in additional penalties over the past 18 months, new figures show.